Abengoa

Abengoa

Annual Report 2013

- Ownership structure General meeting Structure of the company´s governing body Connected transactions and intra-group transactions Risk management and monitoring systems Internal risks monitoring and management systems in relation to the process of financial reporting (System of Internal Control over Financial Reporting or SICFR) Degree to wich corporate governance recommendations are followed Other information of interest

B. General Meeting

B.1 Indicate and detail the differences, if any, between the required quorum and that set forth in the Spanish Corporations Act (LSC) for convening the General Shareholders’ Meeting.

No.

B.2 Indicate and detail the differences, if any, with regards to the system contemplated in the LSC for signing corporate agreements.

No.

B.3 Indicate the rules applicable to the amendment of the company’s bylaws. In particular, the majority required in order for the bylaws to be amended and, as the case may be, stipulate the legal provisions for the protection of the rights of the partners in the amendment of the bylaws.

Article 11 of the rules of the General Meeting of Shareholders establishes a special quorum for the ordinary or extraordinary general meeting to be deemed as having validly agree on the issuance of bonds, the increase or reduction of capital, changing, merging or splitting of the company and, in general, on any amendments whatsoever to the Bylaws: it would be necessary for at least fifty percent of the subscribed equity with voting rights to be present or represented at the shareholders’ meeting, on the first call or twenty five percent of said capital on the second call. In the event of the attendance of shareholders with less than twenty-five percent of the subscribed capital with voting rights, decisions may only be taken with the favourable votes of two thirds of the capital present or represented in the Meeting”.

Article 8 of the bylaws establishes certain rules and regulations for the purpose of protecting minority shareholders in matters regarding the amendment of bylaws:

- “1st Separate voting in matters of the amendment of bylaws or agreements and other operations that may negatively affect class B shares

The amendment of bylaws or agreement that may directly or indirectly damage or negatively affect the pre-emptive rights or privileges of class B shares (including any amendment of the precautionary bylaws regarding class B shares or any agreement that may damage or negatively affect class B shares in comparison with class A shares, or that may benefit or favourably affect class A shares in comparison with class B shares) shall require, in addition to it being approved pursuant to the stipulations of these bylaws, an approval by a majority of class B shares in circulation at the time. For explanatory but by no means limiting purposes, said precaution shall entail as follows: the elimination or amendment of the precaution set forth herein on the principles of proportionality between the number of shares representing class A shares, those of class B and those of class C (if already issued) over the total of the company’s shares in the issuance of new shares or securities or instruments that may give rise to conversion, exchange or acquisition, or in any other manner, that may suppose a right to receive the company’s shares; the partial or total exclusion, of a non-egalitarian nature for shares of class A, class B and class C (as the case may be), of the pre-emptive and other analogous rights that may be applicable by Law and by these bylaws; the repurchase or acquisition of the company’s own shares that may affect class A shares, class B shares and class C shares (as the case may be), in a non-identical manner, in their terms and conditions, price or in any other manner, and which may exceed that which is produced under the framework of ordinary operation of treasury stock or which may give rise to amortization of shares or to the reduction of capital in a non-identical manner for class A, class B or class C shares (as the case may be); the approval of the company’s structural modification that does not amount to treatment identity in all of its aspects for class A and class B shares; the exclusion of the shares of the company from trading on any secondary stock exchange or securities market except through the presentation of an offer of acquisitions for the exclusion from trading as envisaged in the considerations for the class A, class B and class C shares (as the case may be); the issuance of class C or of any other class of preferred or privileged shares that may be created in future.

For that purpose, separate voting shall not be required for the various existing classes of shares to decide on whether to totally or partially exclude, as the case may be, the pre-emptive and other analogous rights that may be applicable pursuant to the Law and these bylaws, simultaneously and identically for class A, class B, as the case may be, and class C shares”

[…]

- “2nd. Matters that have to do with the amendment of bylaws and agreements and other operations that may negatively affect class B shares shall require separate voting

Notwithstanding Article 103 of the Corporations Act, the amendment of bylaws or agreements that may directly or indirectly damage or negatively affect the pre-emptive rights or privileges of class C shares (including any amendments of the precautionary bylaws relating to class C shares or to any agreements that may damage or negatively affect class C shares in comparison with class A and/or class B shares, or that may benefit or favourably affect class A and/or class B shares in comparison with class C shares) shall, in addition to the approvals required pursuant to the stipulations of these bylaws, require approval by a majority of class C shares in circulation at the time. For explanatory but by no means limiting purposes, said precaution shall entail as follows: the elimination or the amendment of the precaution set forth herein on the principles of proportionality between the number of shares representing class A shares, those of class B (if already issued) and those of class C over the total of the company’s shares in the issuance of new shares or securities or instruments that may give rise to conversion, exchange or acquisition, or in any other manner, that may suppose a right to receive the company’s shares; the partial or total exclusion, of a non-egalitarian nature for shares of class A and/or class B and class C of pre-emptive and other analogous rights that may be applicable by Law and these bylaws; the repurchase or acquisition of the company’s own shares that may affect class A and/or class B shares with regards to class C shares, in a non-identical manner, in terms and conditions, in price or in any other manner, and which may exceed that which is produced under the framework of ordinary operation of treasury stock or which may give rise to amortization of shares or to reduction of capital in a non-identical manner for class A, class B (as the case may be) and class C shares; the approval of the company’s structural modification that does not amount to treatment identity in all of its aspects for class A, class B shares (as the case may be) with regards to class C; the exclusion of the shares of the company from trading on any secondary stock exchange or securities market except through the presentation of an offer of acquisitions for the exclusion from the trading as envisaged in the considerations for the class A, (class B as the case may be) and class C shares; the issuance of any other class of preferred or privileged shares that may be created in future.

Notwithstanding the provisions of Article 293 of the Corporations Act, whatever the case may be, the Company’s agreements on capital increase under whatsoever modality and under any formula that may give rise to the first issuance of class C shares shall, in addition to its approval in accordance with the legal provisions and with Article 30 of these Bylaws, require the approval of the majority of class B shares that may be in circulation”

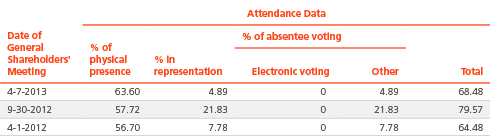

B.4 Give details of attendance at general meetings held during the financial year to which this report refers and during previous financial years.

B.5 Indicate whether there are any restrictions in the Bylaws establishing a minimum number of shares needed to attend the General Shareholders’ Meetings.

Yes.

B.6 Indicate whether it was agreed that certain decisions entailing a structural modification of the company (“subsidiarization”, purchase-sale of essential operational assets, operations equivalent to liquidation of the company...) shall be subject to the approval of the Shareholders’ General Meeting, even if not specifically required under Commercial Laws.

No.

B.7 Indicate the address of and how to access the company’s Website to obtain corporate governance and General Meeting information that should be made available to the shareholders through the Company’s Website.

The Website address of Abengoa SA: www.abengoa.com/es . All the necessary and updated information relating to shareholders meetings can be found under the section of Corporate Governance.

The complete route to follow:

http://www.abengoa.es/web/es/accionistas_y_gobierno_corporativo/juntas_generales/

In compliance with article 539.2 of the Corporations Act, Abengoa approved the regulations for the shareholders’ electronic forum to facilitate communication between shareholders in connection with convening and holding each shareholder’s general meeting. Shareholders may send the following prior to each general meeting:

- Proposals they wish to include on the agenda outlined in the call for the general meeting of shareholders;

- Requests for the inclusion of said proposals;

- Initiatives for acquiring the sufficient percentage for the exercise of a minority voting rights;

- Requests for voluntary representation.

© 2013 Abengoa. All rights reserved