Abengoa

Abengoa

Annual Report 2009

Annual Corporate Governance Report for Listed Public Limited Companies

A - Ownership Structure

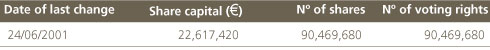

A.1. Complete the following table on the company’s share capital:

Indicate whether different types of share exist with different associated rights:

No

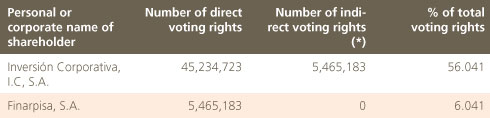

A.2. List the direct and indirect holders of significant ownership interests in your company at year-end, excluding directors:

Indicate the most significant movements in the shareholding structure of the company over the year:

None

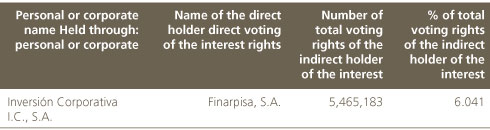

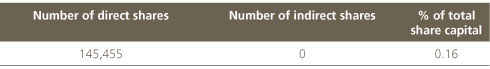

A.3 Complete the following tables on those company directors that hold voting rights through company shares:

In all and each of the cases above, all the shares were acquired by the Board members using their personal funds and in no case whatsoever has there been any handover or delivery by the Company as retribution or consideration.

Complete the following tables on those members of the company’s Board of Directors that hold rights over company shares:

The directors do not hold rights over company shares.

A.4 Indicate, as applicable, any family, commercial, contractual or corporate relations between owners of significant shareholdings, insofar as these as known by the company, unless they bear little relevance or arise from ordinary trading or course of business:

No record

A.5 Indicate, as applicable, any commercial, contractual or corporate relations between owners of significant shareholdings on the one hand, and the company and/or its group on the other, unless these bear little relevance or arise from ordinary trading or course of business:

No record

A.6 Indicate whether any shareholders’ agreements affecting the company have been communicated to the company pursuant to Art. 112 of the Spanish Securities Market Act (Ley del Mercado de Valores). If so, provide a brief description and list the shareholders bound by the agreement:

There is no record of any shareholders’ agreements.

Specify whether the company is aware of the existence of any concerted actions among its shareholders. If so, provide a brief description:

No record

Expressly indicate any amendments to, or terminations of such agreements or concerted actions during the year:

No record

A.7 Indicate whether any individuals or bodies corporate currently exercise, or could exercise control over the company pursuant to Article 4 of the Spanish Securities Market Act (Ley del Mercado de Valores). If so, please identify:

Personal or corporate name:

Inversión Corporativa, I.C., S.A.

Comments

In accordance with Article 4 of the Spanish Securities Market Act, the company Inversión Corporativa holds more than 50% of the share capital.

A.8 Complete the following tables on the company’s treasury stock:.

At year end:

(*) Held through:

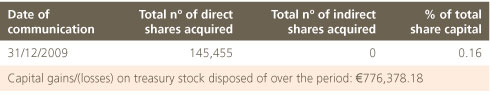

Provide details of any significant changes during the year, in accordance with Royal Decree 1362/2007 (Real Decreto 1362/2007).

A.9 Provide details of the applicable conditions and timeframes governing the powers of the Board of Directors, as conferred by the General Shareholders’ Meeting, to acquire and/or transfer treasury stock.

A resolution was adopted at the Ordinary General Shareholders’ Meeting held on 5 April 2009 to authorize the Board of Directors to buy back the company’s own shares, either directly or through subsidiary or associate companies, subject to the maximum limit prescribed by applicable law and regulations and for a purchase price of between three euro cents (€0.03) and one hundred and twenty euros and twenty cents (€120.20) per share. The Board is entitled to exercise this power for the term of eighteen months counted from such date, in strict accordance with the terms of Chapter IV, Section Four of the Consolidated Text of the Spanish Public Limited Companies Act (Ley de Sociedades Anónimas).

On November 19, 2007, the company signed an agreement with Santander Investment Bolsa, S.V., the aim being to enhance the liquidity of transactions involving shares, ensure consistent stock prices and avoid fluctuations caused by non-market trends, without this contract interfering with the normal functioning of the market and in strict compliance with applicable stock market law. Although the agreement does not meet the conditions set forth in Circular Notice 3 dated 19 December 2007 (Circular 3/2007) of the Spanish Securities and Exchange Commission (Comisión Nacional del Mercado de Valores, hereinafter CNMV), Abengoa has been voluntarily complying with the information reporting requirements prescribed by said Circular Notice 3/2007 for such purpose. The transactions effected under the aforesaid Agreement have been duly communicated on a quarterly basis to the Spanish CNMV and likewise posted on the company’s website.

On December 31, 2009, the balance of treasury stock amounted to 145,455.

In relation to transactions performed over the year, the number of treasury shares acquired stood at 14,704,779, while treasury shares disposed of amounted to 16,754,272, with a net operating result of €776,378.18.

A.10 Indicate, as applicable, any restrictions imposed by law or the Bylaws on voting rights, as well as any legal restrictions on the acquisition or transfer of ownership interests in the share capital. Indicate whether there are any legal restrictions on exercising voting rights:

Maximum percentage of voting rights that a shareholder may exercise by reason of legal restriction: No restriction

No restriction

Indicate whether there are any restrictions included in the company’s Bylaws on exercising voting rights:

No legal restrictions on voting rights. Attendance to the Assembly implies the ownership of at least 1,500 shares without prejudice of the right of proxy, delegation or grouping to which all shareholders are entitled.

Maximum percentage of voting rights that a shareholder may exercise by reason of restrictions included in the Bylaws:

No restriction

Indicate whether there are any legal restrictions on the acquisition or transfer of holdings in the share capital:

No restriction

A.11 Indicate whether the General Shareholders’ Meeting has agreed to adopt neutralization measures to prevent a public takeover bid pursuant to the provisions of Act 6/2007 (Ley 6/2007).

The matter has not arisen

Where applicable, explain the approved measures and terms under which restrictions will be rendered ineffective:

B - Structure of the company’s governing bodies

B.1 Board of Directors

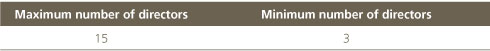

B.1.1 Indicate the maximum and minimum number of directors stipulated in the company Bylaws:

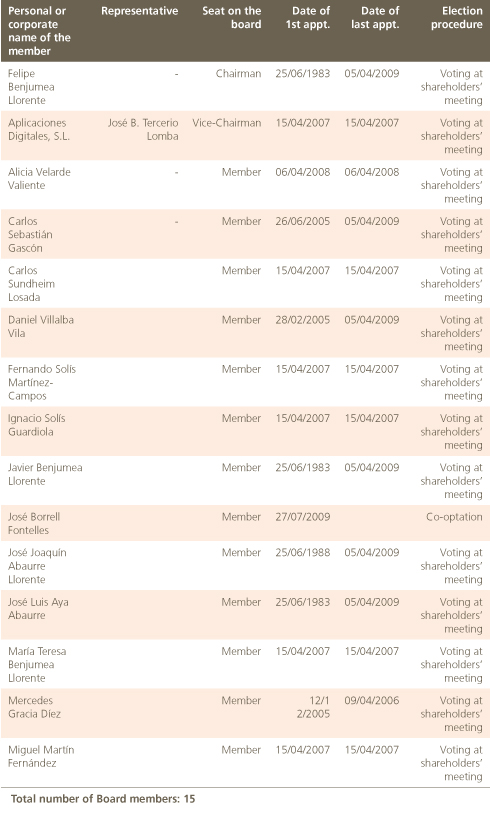

B.1.2 Complete the following table on the members of the Board of Directors:

Identify any members who left the Board of Directors over the period:

Upon a motion adopted at the Appointments and Remuneration Committee meeting held on July 27, 2009, and following Mr Miguel Ángel Jiménez-Velasco Mazarío’s departure as Board member (he will continue to act as Secretary to the Board), the Board adopted a resolution, by co-optation, to appoint Mr José Borrell Fontelles as Board member for a four-year term of office.

B.1.3 Complete the following tables on the different types of members of the board:

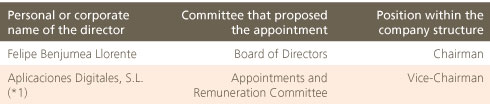

Executive directors

Total number of executive directors: 2

% of total Board of Directors 13,33

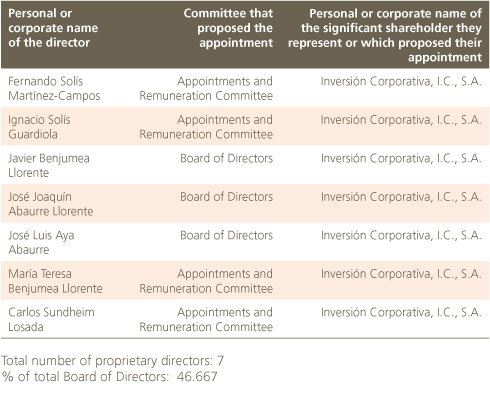

External Proprietary Directors

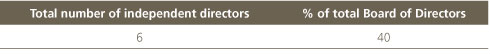

Independent external directors

Personal or corporate name of the director: Prof. Alicia Velarde Valiente

Profile: Independent

She was born in Madrid on 28th October 1964 and studied at ICE Pablo VI from where she graduated with Magna Cum Laude. Law Degree from San Pablo University Studies Centre (Universidad Complutense) obtaining 21 distinctions (A+), 3 As and 1 A-. In 1990 she passed the Notary exams and became a Notary Public. During the 1994-1995 academic years she taught Civil Law at Universidad Francisco de Vitoria, where she remained until 1999. She is still connected with this University where from 1999 to the present, she teaches Master Lectures in the Masters in Canon Law, under the Directorship of Mr. José Mª Iglesias Altuna.

Personal or corporate name of the director Prof. Carlos Sebastián Gascón

Profile: Independent

Mr Gascón (born in Madrid in 1944) studied at the universities of Madrid, Essex (UK) and the London School of Economics. He has been professor of Introduction to Economic Analysis at Madrid’s Universidad Complutense since 1984. Outside his academic life, he has served as Director General for Planning attached to the Spanish Ministry of the Economy, director of the Fundación de Estudios de Economía Aplicada (FEDEA) and consultant and director of various private companies. He currently sits on the boards of Abengoa, S.A., Abengoa Bioenergía, S.A. and Gesif, S.A. He is likewise a member of the Boards of Trustee of Fundación Real Madrid and of the Scientific Committee of Fundación de Estudios Financieros. He has written many articles and papers on macroeconomics, the workplace, economic growth and the institutional economy and is also a regular columnist for the Cinco Días economic newspaper.

Personal or corporate name of the director Prof. Daniel Villalba Vila

Profile: Independent

Mr Villalba is professor of Business Structure at Madrid’s Universidad Autónoma, and holds a doctorate in Economic and Business Sciences from the Universidad Autónoma de Madrid and a master’s degree in Science in Operations Research from Stanford University. He has served as chairman of Inverban, Sociedad de Valores y Bolsa (securities and stock trading company), director of the Madrid Stock Exchange and chairman and director of various non-listed companies. He has had over 50 of his articles and books published to date.

Personal or corporate name of the director Prof. Mercedes Gracia Díez

Profile: Independent

Professor of Econometrics at Madrid’s Universidad Complutense and at Centro Universitario de Estudios Financieros. She has had her scientific work published in the Journal of Business and Economic Statistics, Review of Labor Economics and Industrial Relations, Applied Economics and the Journal of Systems and Information Technology. Director of Balance Sheet Management at Caja Madrid (1996-1999). Head of the Economics and Law Division of the Agencia Nacional de Evaluación y Prospectiva, 1993-1996.

Personal or corporate name of the director: Miguel Martín Fernández

Profile: Independent

Mr Martín is currently chairman of the Asociación Española de Banca. He previously served as Deputy Governor and General Director of Credit Institution Oversight at the Spanish Central Bank, Deputy Secretary for the Spanish Ministry of Economy and Finance, Chairman of the Instituto de Crédito Oficial (ICO), Deputy Secretary for Budget and Public Spending and General Director of the Treasury for the Spanish Treasury Department. Prior to that, he was a member of the Economic and Financial Committee of the European Union and of the Monetary Committee of the European Union. He has also been awarded the prestigious honorary title “Gran Cruz de la Orden del Mérito Civil”.

Personal or corporate name of the director: Prof. José Borrell Fontelles

Profile: Independent

Mr Borrell Fontelles (born 24/04/1947) is professor of Introduction to Economic Analysis at Madrid’s Universidad Complutense and is to be the next Chairman of the European University Institute in Florence. He studied aeronautic engineering at the Universidad Politécnica in Madrid, and also holds a doctorate in Economic Sciences, a master’s degree in Operations Research from Stanford and a further master’s from Paris’ Institut Français du Pétrole. He worked as an engineer at Compañia Española de Petróleos (1972-1981) and, between 1982 and 1996, he served successively as Secretary General for Budget, Secretary of State for Finance and Minister for Public Works, Telecommunications, Transport and the Environment. He was President of the European Parliament over the first half of the 2004-2009 legislative term and President of the Development Assistance Committee over the second.

Other external directors

None

Explain the reasons for why these cannot be considered independent or proprietary directors and detail their connections with the company, its executives or its shareholders.

Not applicable.

Detail any changes in the classification of directors that may have taken place over the year:

There have not been any changes whatsoever to the status of any director. Since 27/07/2009 the number of executive board members has reduced from three to two, following the resignation of Miguel A. Jiménez-Velasco Mazarío as board member on said date

B.1.4. Explain, where applicable, the reasons for why proprietary directors have been appointed at the request of shareholders whose stake amounts to less than 5% of the share capital.

Not applicable.

Detail any failure to address formal requests for board representation made by shareholders whose stake equals or exceeds that of others at whose request proprietary directors have been appointed. If so, explain why the request was not entertained.

Not applicable.

B.1.5. Indicate whether any director has left their post before the end of their term of office, whether they explained their reasons to the Board and by which means and, if this was served in writing to the entire Board, explain the reasons given as a bare minimum:

Upon a motion adopted at the Appointments and Remuneration Committee meeting held on July 27, 2009, and following Mr Miguel Ángel Jiménez-Velasco Mazarío’s departure as Board member (he will continue to act as Secretary to the Board), the Board adopted a resolution, by co-optation, to appoint Mr José Borrell Fontelles as Board member for a four-year term of office. The resignation came about as a consequence of the intensification of his professional occupations for this same company, which made his exclusive dedication became advisable, thus giving rise to his resignation from the organ of administration.

B.1.6. Indicate, if applicable, the powers vested in any Chief Executive Officers:

There is currently no Chief Executive Officer, in that the Board of Directors has vested all delegable powers in Mr Felipe Benjumea. Mr José Terceiro has been granted a power of attorney to represent the company for general matters.

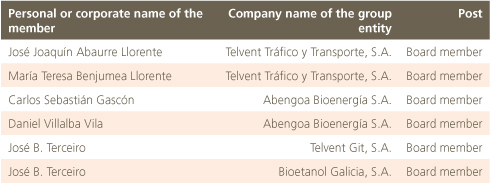

B.1.7. Identify, where applicable, any Board members who hold administrative or executive posts in other companies that belong to the same business group as the listed company subject to this report:

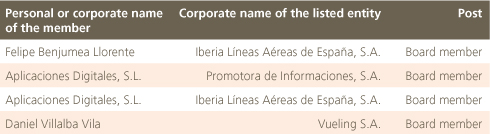

B.1.8 Provide details, where applicable, of any company Board members who also sit on the boards of other entities that do not belong to the same business group and are listed on official securities markets in Spain, insofar as these are known by the company:

B.1.9 Indicate whether the company has established rules on the number of Boards on which its own Board members may sit. If so, provide details:

No

B.1.10 In relation to recommendation number 8 of the Unified Code, indicate the company’s general strategies and policies that must be approved by plenary session of the Board of Directors:

Investment and financing policy

Yes

Definition of the structure of the business group

Yes

Corporate governance policy

Yes

Corporate social responsibility policy

Yes

Strategic or Business Plan, as well as the budget and management targets

Yes

The remuneration and performance assessment policy for senior executives

Yes

Risk control and management policy, as well as the periodic monitoring of internal information and control systems

Yes

Dividends and treasury stock policy and, in particular, limits thereto

Yes

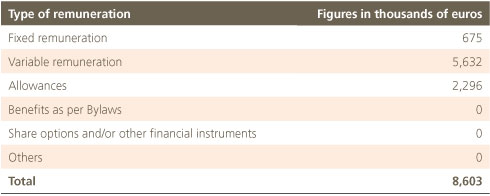

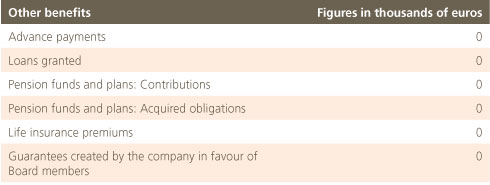

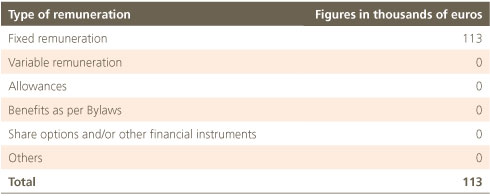

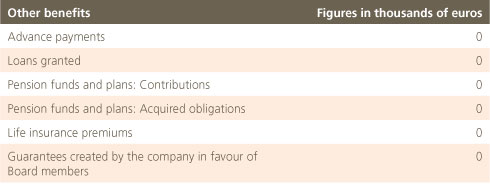

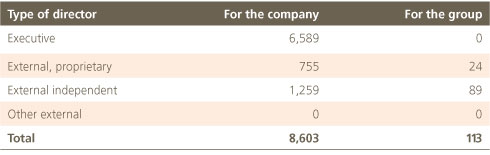

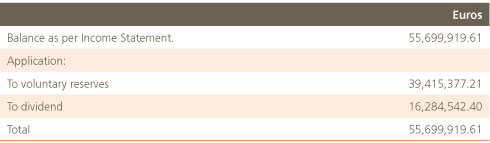

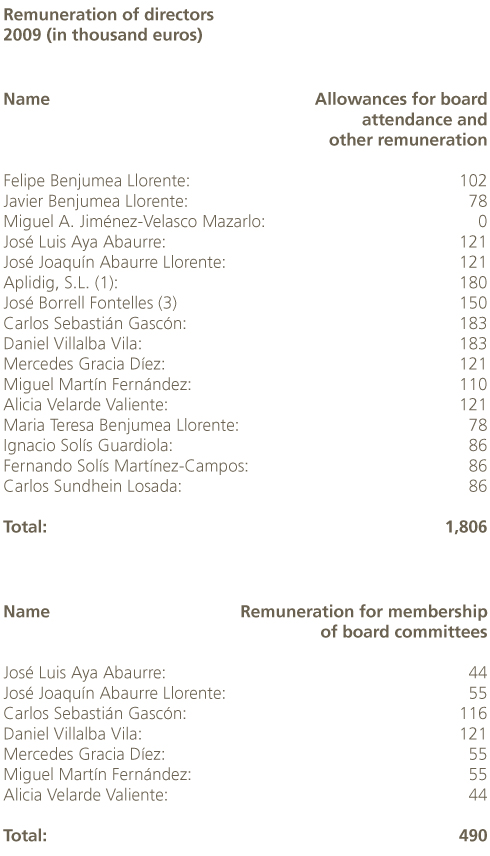

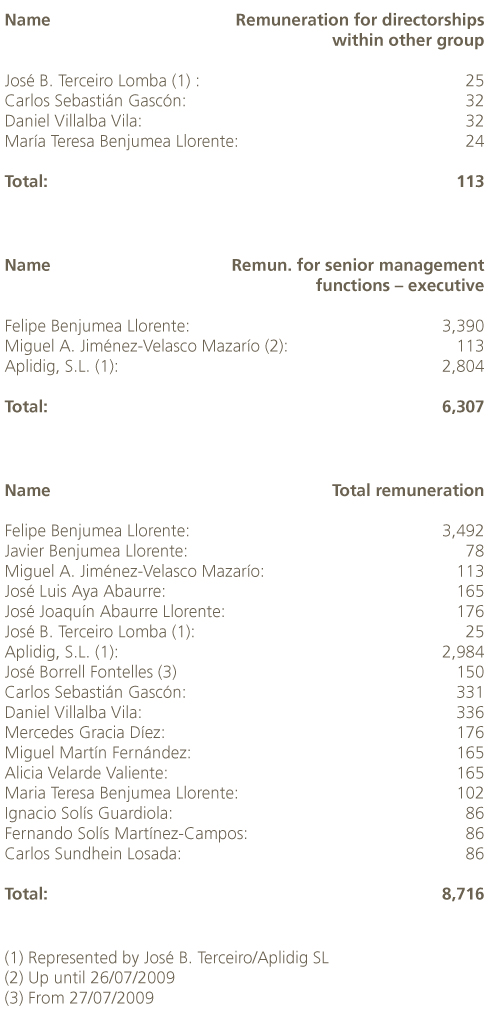

B.1.11 Complete the following tables on the aggregate remuneration of Board members accrued over the financial year:

a) For the company covered by this report:

b) Remuneration payable to members of the company’s Board of Directors due to positions held on other Boards of Directors and/or within the senior management of other group companies:

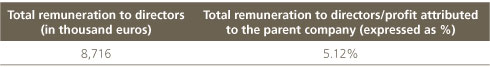

c) Total remuneration by type of director:

d) Total remuneration by type of director:

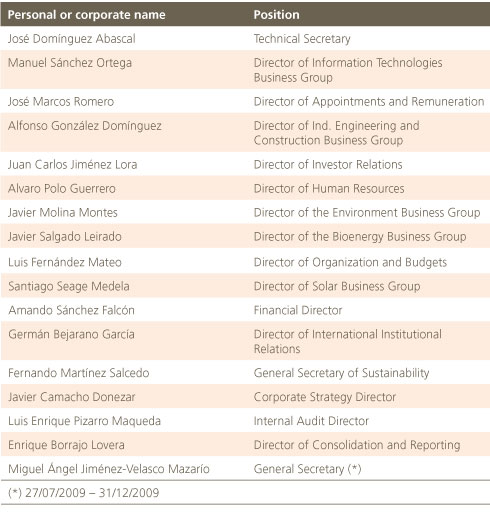

B.1.12 Identity any members of the senior management that are not in turn executive directors, and indicate the total remuneration payable thereto during the financial year:

Total remuneration paid to the senior management (in thousand euros): 6,883

B.1.13 Identify, on an aggregate basis, whether members of the company’s or group’s senior management team, including executive directors, are afforded guarantees or golden parachute clauses in the event of dismissal or changes of control. Indicate whether these contracts must be communicated to, and/or approved by the governing bodies of the company or its group:

There are no contracts or lists of the indicated. Whatever the case may be it is the competence of the Board of Administration upon the proposal of the Appointment and Remunerations Committee, which, as already indicated, has not yet been exercised

B.1.14 Describe the process for establishing the remuneration of Board members and the relevant provisions of the Bylaws.

Process for establishing the remuneration of Board members and relevant Bylaws

Established by the Appointments and Remuneration Committee, Art. 39 of the Bylaws, Remuneration Policy Report for company directors presented to the General Shareholders’ Meeting.

Indicate whether the following decisions must be approved by plenary session of the Board:

Following a proposal from the company’s chief executive, the appointment and removal of senior executives, including their compensation clauses.

Yes

The remuneration of Board members and, in the case of executive ones, the additional remuneration for their executive functions and other conditions set forth in their contracts.

Yes

(Regarding the last section and it being the competence of the Board, there was no report of any contract of that nature during the exercise, or during previous exercises, such that there are no special conditions to report)

B.1.15 Indicate whether the Board of Directors approves a detailed remuneration policy and explain the matters covered therein:

Amount of fixed remuneration items, including a breakdown, where applicable, of allowances for participation on the Board and its committees and an estimation of the annual fixed remuneration to which they give rise.

Yes

Variable remuneration items.

Yes

Main characteristics of the benefits system, with an estimation of their annual amount or equivalent cost.

Yes

Conditions that must be contained within the contracts of those who perform senior management functions as executive directors.

Yes

(Regarding the last section, and it being the competence of the Board, there was no report of any contract of that nature during the exercise, or during previous exercises, such that there are no precedents).

B.1.16 Indicate whether the Board submits a report on the directors’ remuneration policy to the advisory vote of the General Shareholders’ Meeting, as a separate item on the agenda. If so, explain those aspects of the report concerning the remuneration policy as approved by the Board for forthcoming years, the most significant departures in such policies compared to that applied during the financial year in question and an overall summary of how the remuneration policy was applied over the financial year in question. Outline the role played by the Remuneration Committee and, if external consultancy was sought, the identity of the external consultants that provided it.

Yes. The Appointment and Remunerations Committee reported on the following during the 2009 exercise:

Follow-up and progress on remunerations of members of the Board of Administration and of the company’s upper management;

Proposal on remunerations for members of the Board of Administration and for the company’s upper management;

Preparing the relevant information that should be included in the yearly financial statements;

Making a proposal to the Board of Administration for the appointment of board member Mr. José Borrell Fontelles by co-optation, following the resignation of Mr. Miguel Ángel Jiménez-Velasco Mazarío;

Proposal to the Board of Administration to subject the ratification of Mr. José Borrell Fontelles as Board member, previously appointed by co-optation as independent board member, to the next General Assembly of Shareholders to be held;

Proposal to the Board of Administration for the approval of the Annual Report on the Policy of Remuneration of Administrators;

The Report on the verification of the maintenance of the conditions on which board members were appointed and on their character or typology;

Proposal to the Board of Administration on the report on the remuneration of the members of the Board of Administration and the Top Executive;

The Reports on the market studies and comparatives of remunerations carried out by independent experts.

Issues covered in the remuneration policy report

Amount of fixed remuneration and variable remuneration items.

Role played by the Remuneration Committee

Preparation of the proposal to the Board, stating grounds.

Did the company seek external consultancy?

Yes

Identity of external consultants

Three independent external consultancy firms.

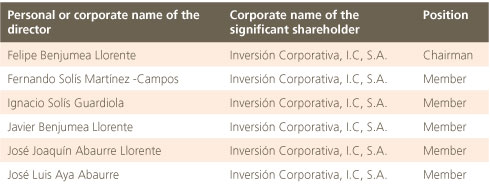

B.1.17. Indicate, if applicable, the identity of those Board members that are also members of the Board of Directors, executives or employees of companies that hold significant shareholdings in the listed company and/or in entities belonging to its business group:

Provide details, where applicable, of any relevant relations others than those contemplated in the previous section, between members of the Board of Directors and significant shareholders and/or group entities:

Personal or corporate name of the Board member

Felipe Benjumea Llorente

Personal or corporate name of the significant shareholder

Finarpisa, S.A.

Description of the relationship

Chairman of the Board

B.1.18 Indicate whether any amendments were made to the Regulations of the Board of Directors during the financial year:

No

B.1.19 Indicate the procedures for the appointment, reappointment, appraisal and removal of Board members. Provide details of the competent bodies, the processes to be followed and the criteria employed in each of the procedures.

The Appointments and Remuneration Committee is the competent body in all cases and provides the Board of Directors with its duly substantiated proposal, applying the criteria of independence and professionalism as established in the regulations governing the Board and the Committee itself.

The performance of the board members and of the executive board members is evaluated on the proposal of the Appointments Commission through a reasoned report filed to the Board during its first meeting of the following quarter, after the closing of the previous exercise and upon obtaining or at least knowing the estimate of the accounts closure for the exercise and receiving the report from the auditor, which are essential as evaluation criteria.

B.1.20 Indicate the cases in which Board members are obliged to resign.

Directors are removed from office when the term for which they were appointed comes to an end, and similarly in all other cases when removal or resignation is required pursuant to applicable law, the Bylaws or these Regulations.

Directors must offer to resign and, if the Board of Directors considers it appropriate, tender their resignation in the following cases:

a) In any of the cases of incompatibility or prohibition prescribed by law.

b) When they are severely punished by a public authority for having violated their obligations as Board members.

c) When asked to do so by the Board itself for having violated their obligations as Board members.

Thus, Article 13 (Board Member Dismissal) of the Board of Administration Regulations establishes that:

1. Board Members shall be dismissed from their posts after the period for which they were appointed and under all the other assumptions pursuant to the Law, the Bylaws and this Regulation.

2. Board Members are bound to place their posts at the disposal of the Board of Administration and to sign, should the Board deem it convenient, the relevant resignation in the following cases:

a) If they are involved in any of the legally envisaged assumptions of prohibition, incompatibility or conflicts of interest;

b) If they are severely punished by any public authority for infringing upon their obligations as Board Members;

c) Should the Board itself request it so for having infringed upon their obligations as Board Members;

3. Once the period ends or is terminated, for any other reason, said board member, in the performance of its duty, may not render any services to any other competing entity for a period of two years, except if the Board of Administration frees him/her from this obligation or shortens its duration

B.1.21 Explain whether the function of chief executive of the company falls upon the Chairman of the Board of Directors. If so, indicate the measures that have been taken to limit the risks associated with powers being concentrated in one sole person:

Measures to limit risks

In accordance with that set forth in article 44 bis of the company’s Bylaws, the Board of Directors set up the Audit Committee and the Appointments and Remuneration Committee on December 2, 2002 and February 24, 2003, respectively.

These committees are vested with the necessary non-delegable powers stemming from the responsibilities assigned to them by law, the Bylaws and their respective internal regulations. They have been set up to control and oversee those matters that fall within their remit.

Both are presided over by an independent, non-executive director, and likewise comprise a majority of independent and non-executive directors.

On December 10, 2007, the Board of Directors adopted a resolution to appoint Mr José B. Terceiro Lomba (on behalf of Aplicaciones Digitales, S.L.), the current coordinating director, as the executive Vice-Chairman of the Board of Directors, with the express approval of the other company directors, and particularly the independent directors.

The existence of only two executive directors, pursuant to the foregoing, in contrast to the large majority of independent or external directors, ensures that the decisions of the senior executive officer are effectively controlled.

Indicate and, where applicable, explain whether rules have been established that empower one of the independent Board members to request that a meeting of the Board be convened, or that new items be added to the agenda, the aim being to coordinate and echo the concerns of the external directors and oversee evaluation by the Board of Directors.

Explanation of the rules

The Board of Directors is currently composed of fifteen members. The Regulations of the Board of Directors govern its composition, functions and internal organization. In addition, there is an Internal Code of Conduct in Stock Markets, the scope of which extends to members of the Board of Directors, senior management and all those employees who, on account of their posts or assigned duties, may be affected by its content. The Regulations of the General Shareholders’ Meeting govern the formal and internal aspects of such meetings. Lastly, the Board of Directors is assisted by the Audit Committee and the Appointments and Remuneration Committee, which both have their own Internal Regulations. All these regulations, brought together in a consolidated text of the Internal Corporate Governance Regulations, are available at the company’s website, www.abengoa.com. Since its inception, the Appointments and Remuneration Committee has been analyzing the structure of the company’s governing bodies and has been working to adapt it to incorporate corporate governance recommendations, paying particular attention to the historic and special configuration of these bodies within Abengoa. In accordance with this analysis, in February 2007 the Committee recommended the creation of the post of coordinating director, coupled with the elimination of the Advisory Committee to the Board of Directors. The first measure was in order to incorporate the most recent corporate governance recommendations, as created in Spain in 2006, whereas the second was proposed because the Committee considered that the Advisory Committee had already fulfilled the function for which it was originally created and that its coexistence with the corporate bodies could lead to conflicts of power. Both proposals were approved at a meeting of the Board of Directors held in February 2007 and at the General Shareholders’ Meeting held on April 15 of the same year, and José B. Terceiro was appointed (on behalf of Aplicaciones digitales, S.L.) as coordinating board member, in his capacity as independent member. On a final note, in October 2007 the Committee proposed to the Board that it accept the resignation of Mr. Javier Benjumea Llorente from his position as Vice-Chairman, with the consequent revocation of his delegated powers, and likewise accept the appointment of a new natural person to represent Abengoa and the Focus-Abengoa Foundation in those entities or companies in which they have an appointed position.

The Committee then considered it advisable to recommence its study on the number and characteristics of the Vice-Chairman of the Board of Directors within the current structure of governing bodies.

As a result of this, the Committee thought it necessary for the Vice-Chairman of Abengoa to have the powers conferred by the Spanish Public Limited Companies Act (Ley de Sociedades Anónimas) with regard to the organic representation of the company on the one hand, and, on the other, as a counterweight to the functions of the Chairman within the Board of Directors. On this basis, it considered that a coordinating director – with the functions assigned to that position by the resolutions of the Board of Directors (February 2007) and the General Shareholders’ Meeting (April 2007) – would be the ideal figure, given the corporate governance recommendations and the structure of the company, as well as the composition and diversity of its directors. The coordinating director has already been entrusted with the task of coordinating the concerns and motivations of the other Board members, and as such has the power to request that a Board meeting be convened and that new items be included on the agenda. In its role as the visible head of Board members’ interests, it has, more de facto than de jure, a certain representative nature on the Board, and it therefore seemed appropriate to confirm and expand this representation by making the post both institutional and organic. For the reasons outlined above, the Committee proposed Aplicaciones Digitales, S.L. (Aplidig, represented by Mr José B. Terceiro Lomba), the current coordinating director, as the new Vice-Chairman to the Board of Directors. In addition, and within the functions of organic representation, the current Vice-Chairman, jointly with the Chairman of the Board, was put forward as the physical representative of Abengoa in its capacity as the Chair of the Focus-Abengoa Foundation, as well as in any other foundations and institutions in which the company is or must be represented.

In view of the above, on December 10, 2007, the Board of Directors agreed to appoint Aplicaciones Digitales, S.L. (represented by Mr José B. Terceiro Lomba), the current coordinating director, as executive Vice-Chairman of the Board of Directors, with the unanimous consent of the independent directors for the company to continue acting as coordinating director in spite of its new appointment as executive Vice-Chairman. In addition, and within the functions of organic representation (conferred by means of a power of attorney granted by the Board of Directors on July 23, 2007), the Vice-Chairman, jointly with the Chairman of the Board of Directors, has been put forward as the physical representative of Abengoa, in its capacity as the Chair of the Board of the Focus-Abengoa Foundation, as well as in any other foundations and institutions in which the company is or must be represented.

B.1.22 Are reinforced majorities (different to legal majorities) required for any type of resolution?

No

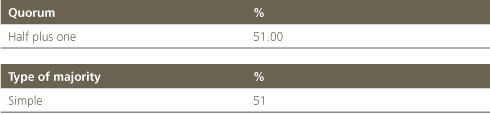

Indicate how the resolutions of the Board of Directors are adopted, stating, at least, the minimum quorum and the types of majorities required to adopt the resolutions:

Description of the resolution:

All, save ones for which legally reinforced majorities are required.

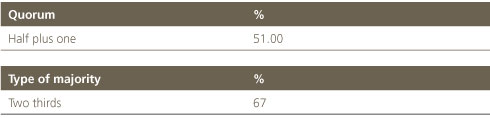

Description of the resolution:

Delegation of powers

B.1.23 Explain whether there are specific requirements, different from those relating to Board members, in order to be appointed Chairman.

No

B.1.24 Indicate whether the Chairman has a casting vote:

Yes

Matters on which there is a casting vote: In the event of a tie

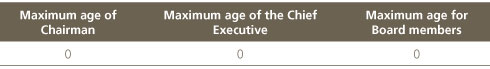

B.1.25 Indicate whether the Bylaws or the Board Regulations establish any limit on the age of directors:

B.1.26 Indicate whether the Bylaws or the Regulations of the Board of Directors establish a limited term of office for independent directors:

No

Maximum term of office: None

B.1.27. If there are few or no female directors, explain the reasons and the initiatives adopted in order to remedy the situation.

Explanation of the reasons and the initiatives

As at 31st December 2009 there were 3 females in a total of 15 board members (20%)

The internal policy of the company, mainly reflected in the Code of Conduct and in the procedure for selecting and hiring workers, excludes all discriminatory measures, actions or omissions

In particular, indicate whether the Appointments and Remuneration Committee has established procedures to ensure that selection processes do not suffer from implicit biases that hamper the selection of female Board members, and whether female candidates who meet the required profile are deliberately sought:

Specify the main procedures

There are no discriminatory measures. The number of female directors increased from one in 2006 to three (25/02/2008).

B.1.28 Indicate whether there are any formal processes in place for granting proxies at Board meetings. If so, provide a brief description:

Not applicable

The second section of Article 10 of the Regulations of the Board of Administration establishes the following:

“Each Board Member may confer his/her representation upon another Board Member without it limiting the number of representations that each may hold for attendance to the Board. The representation of the absent Board Members may be conferred by any written means whatsoever, including telegram, telex or telefax addressed to the Chair.”

B.1.29 Indicate the number of Board meetings held during the financial year. Likewise indicate, where applicable, the number of times the Board met without the Chairman in attendance:

Number of Board meetings 15 (including 3 written meetings)

Number of Board meetings without the attendance of the Chairman 0

Indicate the number of meetings held by the different Board committees during the financial year:

Number of meetings of the Executive or Delegate Committee: Not applicable

Number of meetings of the Audit Committee: 6

Number of meetings of the Appointments and Remuneration Committee: 4

Number of meetings of the Appointments Committee: Not applicable

Number of meetings of the Remuneration Committee: Not applicable

B.1.30 Indicate the number of Board meetings held during the year without the attendance of all its members. Proxies granted without specific instructions for the meeting should be treated as non-attendances:

Number of non-attendances of directors during the year:11

% of non-attendances of the total votes cast during the year: 4.8%

B.1.31 Indicate whether the individual and consolidated annual accounts presented to the Board for approval are previously certified:

Yes

Identify, where applicable, the people who certified the company’s individual and consolidated accounts for approval by the Board:

Amando Sánchez Falcón

Financial Director

Enrique Borrajo Lovera

Director of Consolidation and Reporting

B.1.32 Explain, if applicable, the mechanisms established by the Board of Directors to prevent the individual and consolidated accounts prepared by it from being presented to the General Shareholders’ Meeting with qualifications in the audit report.

The risk control system, the internal audit services and the Audit Committee have been set up to act as mechanisms of periodic and recurrent control and oversight. They identify and, where appropriate, resolve potential situations which, if not addressed, could give rise to incorrect accountancy treatment.

B.1.33 Is the secretary to the Board also a director?

No

B.1.34 Explain the procedures for the appointment and removal of the Secretary to the Board, indicating whether they are proposed by the Appointments Committee and approved by plenary session of the Board.

Appointment and Removal Procedure

Proposal from the Appointments and Remuneration Committee, stating grounds

Does the Appointments Committee communicate appointments? Yes

Does the Appointments Committee communicate removals? Yes

Does the plenary session of the Board approve appointments? Yes

Does the plenary session of the Board approve removals? Yes

Does the Secretary to the Board have special responsibility for ensuring that the recommendations on good governance are followed?

Yes

B.1.35 Indicate, if applicable, the mechanisms established by the company to preserve the independence of the auditor, of financial analysts, of investment banks and of rating agencies.

The Audit Committee is composed of a majority of non-executive directors, thus meeting the requirements set forth in the good governance regulations and, especially, in the Spanish Financial System Reform Act (Ley de Reforma del Sistema Financiero). Likewise, and in accordance with the provisions of article 2 of the Internal Regulations, the office of Chairman to the Committee must be held by a non-executive director.

Functions

The Audit Committee has the following functions and responsibilities:

To report information on the Annual Accounts, as well as on the quarterly and half-yearly financial statements that must be presented to the regulatory or supervisory bodies of the securities markets, with express mention of the internal control systems and the monitoring and fulfillment thereof through the internal audit service and, where applicable, the accountancy criteria applied.

To inform the Board of any changes in the accountancy criteria and in on and off-balance sheet risks.

To report to the General Shareholders’ Meeting on those matters requested by shareholders that fall within its remit.

To propose the appointment of the external financial auditors to the Board of Directors for subsequent referral on to the General Shareholders’ Meeting.

The oversee the internal audit services. The Committee will have full access to the internal audit and will report during the process of selecting, appointing, renewing and removing the director thereof. It will likewise control the remuneration of the latter, and must provide information on the budget of the internal audit department.

To be fully aware of the financial information reporting process and the company’s internal control systems.

To liaise with the external auditors in order to receive information on any matters that could jeopardize the latters’ independence and any others related to the financial auditing process.

To summon those Board members it deems appropriate to its meetings, so that they may report to the extent that the Audit Committee deems fit.

To prepare an annual report on the activities on the Audit Committee, which must be included within the management report.

The same procedure applies to financial analysts, investment banks and rating agencies, including their selection under conditions of competition, confidentiality, and non-interference in other departments

B.1.36 Indicate whether the company changed its external auditor during the financial year. If so, identify the incoming and outgoing auditors:

No

In the event of disagreements with the outgoing auditor, please provide details:

No

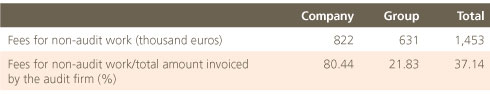

B.1.37 Indicate whether the audit firm carries out other, non-audit work for the company and/or its business group. If so, state the total fees paid for such work and the percentage this represents of the fees billed to the company and/or its business group:

B.1.38 Indicate whether the audit report of the annual accounts for the previous financial year contains reservations or qualifications. If so, detail the reasons given by the Chairman of the Audit Committee to explain the content and scope of such reservations or qualifications.

Not applicable

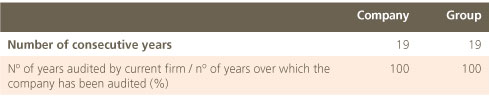

B.1.39 State the number of consecutive years during which the current audit firm has been auditing the annual accounts of the company and/or its business group. Likewise, indicate how many years the current audit firm has been auditing the accounts as a percentage of the total number of years over which the annual accounts have been audited:

B.1.40 Indicate any equity holdings held by company Board members in the capital of entities engaged in the same, analogous or complementary type of business to that which constitutes the corporate purpose of either the company or its business group, insofar as these have been communicated to the company. Likewise indicate the positions or functions they exercise within such companies:

None

B.1.41. Indicate whether there is a procedure whereby directors may seek external consultancy.

Details of the Procedure:

The Secretary to the Board of Directors exercises the functions legally attributed to that position. Currently, the office of secretary and legal consultant are vested in the same person, who is responsible for ensuring that meetings are validly convened and that resolutions are validly adopted on the Board. In particular, he advises Board members on the legality of the deliberations and motions put forward and on compliance with the Internal Corporate Governance Regulations. He therefore guarantees the principle of formal and material legality, which governs the actions of the Board of Directors. The Secretary’s Office to the Board of Directors, as a specialized body set up to ensure the formal and material legality of the Board’s conduct, has the full support of the latter to carry out its functions with complete independence of criteria and stability. It is likewise responsible for monitoring compliance with the internal regulations on corporate governance. Acting on its own initiative or upon the request of Board members, it provides the necessary external consultancy to ensure the Board is kept duly informed.

The Board of Administration has access to external, legal or technical consultants, according to its needs, which may or may not be arbitrated through the Board secretary. The second paragraph of Article 19 of the Regulations of the Board of Administration sets forth that:

“Likewise, through the Chairperson of the Board of Administration, the Board Members shall be empowered to propose to the Board of Administration, by majority, the hiring of legal, accounting, technical, financial, commercial consultants or consultants of any other nature deemed necessary in the interests of the Company for the purpose of providing assistance in the exercise of their duties in dealing with specific problems of certain magnitude and complexity linked with the exercise of such duties.”

In practice, the mere request for consultancy by a board member, whether in the Board and more so in the Audit Committee or in the Appointment and Remunerations Committee, amounts to the use of such request, in spite of the literal interpretation of the aforementioned Article 19.

B.1.42 Indicate whether there is a procedure whereby directors can obtain the information needed to prepare for meetings of the governing bodies sufficiently in advance:

Yes

Details of the procedure:

Documents are sent out, and/or made available at the venue for the Board meeting, before the meeting is held. Nevertheless, in the interest of greater transparency and for information purposes, information shall be articulated in blocks, which may be made available to the board members at the soonest possible time.

B.1.43 Indicate whether the company has established rules that oblige directors to report and, where appropriate, resign in those cases where the image and reputation of the company may be damaged.

Yes

Explain the rules

Art. 13 of the Board Regulations: Board members must offer to resign and, if the Board of Directors considers it appropriate, formalize said resignation in the following cases: When they fall within any of the grounds for incompatibility of prohibition as prescribed by applicable law.

Section (p) of Article 14.2 of the same Regulation also establishes the obligation of the board members to inform the company of all legal and administrative claims and of claims of whatsoever nature which, due to their importance, may severely affect the reputation of the company.

B.1.44 Indicate whether any member of the Board of Directors has informed the company that s/he has been sentenced or formally accused of any of the offences stipulated in Article 124 of the Spanish Public Limited Companies Act (Ley de Sociedades Anónimas):

No

Indicate whether the Board of Directors has analyzed the case. If so, explain the decision taken regarding whether or not the director should remain in his/her post, giving reasons.

No

B.2 Committees attached to the Board of Directors

B.2.1. List all the committees of the Board of Directors and the members thereof:

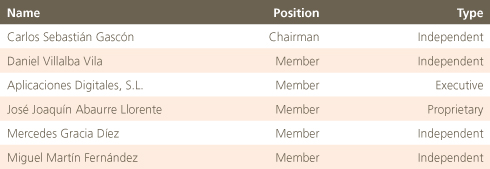

Audit Committee

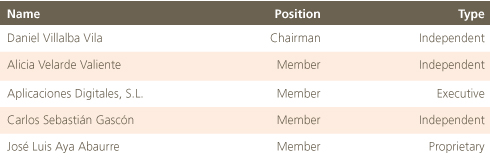

Appointments and Remuneration Committee

B.2.2. Indicate whether the following functions are vested in the Audit Committee:

Monitoring the preparation process and the integrity of the financial information on the company and, where applicable, the group, verifying compliance with legal requirements, proper delimitation of the scope of consolidation and the correct application of accounting criteria.

Yes

Periodically assessing the internal control and risk management systems, so that the main risks are adequately identified, managed and made known.

Yes

Ensuring the independence and efficacy of the internal audit function; proposing the selection, appointment, reappointment and removal of the head of the internal audit service; proposing the budget for such service; receiving periodic information on its activities; and checking that the senior management takes the conclusions and recommendations of its reports into account.

Yes

Establishing and overseeing a mechanism that enables employees to communicate - confidentially and, when considered appropriate, anonymously - any possible irregularities they may observe within the company, particularly financial and accounting ones.

Yes

Presenting to the Board of Directors proposals for the selection, appointment, reappointment and replacement of the external auditor, as well as the conditions under which it is contracted.

Yes

Regularly receiving, from the external auditor, information on the audit plan and the results of its implementation, and checking that the senior management takes its recommendations into account.

Yes

Ensuring the independence of the external auditor

Yes

In the case of groups, helping to ensure that the group auditor also conducts the audits for individual group companies

Yes

B.2.3. Describe the rules governing the organization, functioning and responsibilities of each of the Committees attached to the Board of Directors.

(I) Name of the Committee

Appointments and Remuneration Committee

Brief description

The Appointments and Remuneration Committee is composed of a majority of non-executive directors, thereby fulfilling the requirements established in the Financial System Reform Law (Ley de Reforma del Sistema Financiero). Likewise, in accordance with that envisaged in Article 2 of its Internal Regulations, the position of Chairman of the Committee must be held by a non-executive director.

Functions

The Appointments and Remuneration Committee is entrusted with the following functions and responsibilities:

1. To report to the Board of Directors on appointments, reappointments, removals and the remuneration of the Board and its component posts, as well as on the general policy of remunerations and incentives for positions on the Board and within the senior management.

2. To report, in advance, on all proposals that the Board of Directors presents to the General Shareholders’ Meeting regarding the appointment or removal of directors, even in cases of co-optation by the Board itself; to verify, on an annual basis, continuing compliance with the requirements governing appointments of directors and the nature or type thereof, all of this being information included in the Annual Report. The Appointments Committee will ensure that, when vacancies are filled, the selection procedures do not suffer from implicit bias that hinders the selection of female directors and that women who meet the required profile are included among the potential candidates.

3. To prepare an annual report on the activities of the Appointments and Remuneration Committee, which must be included in the Management Report.

Organization and functioning

The Appointments and Remuneration Committee will meet as often as necessary in order to perform its functions, and at least once every six months.

A quorum is deemed to exist when the majority of its members are present. Proxies may only be granted to non-executive directors. The resolutions adopted shall be valid when the majority of the members of the Committee, present or represented by proxy, vote in favor. In case of a tie, the Chairman will cast the deciding vote.

The Committee shall meet on the occasions necessary to fulfil its functions and, at least, once a quarter. In 2009 it met on four occasions.

The Audit Committee and the Appointment and Remunerations Committee were formed on 2nd December 2002 and on 24th February 2003, respectively. On the same date, the Board of Administration prepared a proposal to modify the Bylaws for the purpose of incorporating the forecasts relating to the Audit Committee, the proposal of the Regulations on the development of Shareholders Assemblies, the partial modifications to the Regulations of the Board of Administration and, finally, the Regulations on the internal system of the Audit Committee and of the Appointment and Remunerations Committee, approved by the General Assembly on 29th June 2003.

In February 2004 the composition of both commissions was modified for the purpose of permitting independent board members from outside the Company to become members of those commissions. Consequently, the Audit Committee and the Appointment and Remunerations Committee were now made up of board members, all of whom were non-executive and most of whom were independent, in accordance with what is established in the Financial System Reform Law. As a result, the first two independent board members were appointed by the Board of Administration since there was still, logically, no appointment committee. Said independence is also ratified on annual basis by the Appointment Commission. Upon its forming, the proposal for the appointment of board members became part of its competence, and since then the aforementioned commission has been the one making the proposals to the Board of Administration

(II) Name of the Committee

Audit Committee

Brief description

The Audit Committee is composed of a majority of non-executive directors, thereby fulfilling the requirements established in the good governance regulations and, especially, in the Financial System Reform Act. Likewise, in accordance with that envisaged in Article 2 of its Internal Regulations, the office of Chairman of the Committee must be held by a non-executive director.

Functions

The Audit Committee is entrusted with the following functions and responsibilities:

1. To report on the annual accounts, as well as the quarterly and half-yearly financial statements that must be presented to the regulatory or supervisory bodies of the securities markets, with express mention of the internal control systems, verification of compliance and monitoring through internal audit and, when applicable, the accountancy criteria applied.

2. To inform the Board of any change in the accountancy criteria, and any risks either on or off the balance sheet.

3. To report at the General Shareholders’ Meeting on any matters requested by shareholders that fall within its remit.

4. To propose the appointment of the external financial auditors to the Board of Directors for subsequent referral on to the General Shareholders’ Meeting.

5. To monitor the internal audit services. The Committee will have full access to the internal audit and will report during the process of selection, appointment, renewal and cessation of the internal audit director. Likewise, it will monitor the remuneration of the director and must report on the budget of the department.

6. To be fully aware of the financial information reporting process and the company’s internal control systems.

7. To liaise with the external auditors to receive information on any matters that could jeopardize their independence and any others related to the financial auditing process.

8. To summon any Board members it considers appropriate to its meetings so that they may report to the extent that the Audit Committee deems fit.

9. To prepare an annual report on the activities of the Audit Committee, which must be included in the Management Report.

Organization and functioning

The Audit Committee will meet as often as necessary in order to discharge its functions, and at least once every quarter. The Committee met 6 times over 2009.

The Audit Committee is considered validly constituted when the majority of its members are present. Proxies may only be granted to non-executive directors

B.2.4. Indicate the powers of each committee with regard to consultancy, consultation and, where applicable, delegation:

(I) Name of the Committee

Appointments and Remuneration Committee

Brief description

To report to the Board of Directors on appointments, reappointments, cessations and remunerations of the Board and its posts, as well as the general policy of remunerations and incentives for Board members and for the senior management. To report, in advance, on all proposals that the Board of Directors presents to the General Shareholders’ Meeting regarding the appointment or cessation of directors, even in cases of co-optation by the Board of Directors itself; to verify, on an annual basis, continuing compliance with the requirements for appointments of directors and the relevant nature or type of director. This information must be included in the annual report. The Appointments Committee will ensure that, when vacancies are filled, the selection procedures do not suffer from implicit biases that hinder the selection of female directors and that women meeting the required profile are included among the potential candidates. Likewise, to prepare an annual report on the activities of the Appointments and Remuneration Committee, which must be included in the Management Report.

(II) Name of Committee

Audit Committee

Brief description

To report on the annual accounts, as well as the quarterly and half-yearly financial statements. To inform the Board of any change in the accountancy criteria, or any risks either on or off the balance sheet. To report at the General Shareholders’ Meeting on those matters requested by shareholders that fall within its remit. To propose the appointment of the external financial auditors to the Board of Directors, for subsequent referral on to the General Shareholders’ Meeting.

B.2.5 Indicate, where applicable, the existence of regulations governing the committees attached to the Board, the place where they are available for consultation and any amendments that may have been made during the financial year. Likewise indicate whether an annual report on the activities of each committee has been voluntarily prepared.

(I) Name of the Committee

Appointments and Remuneration Committee

Brief description

The Regulations of the Audit Committee and the Regulations of the Appointments and Remuneration Committee are both available from the company’s website and also from the CNMV (Spanish Securities and Exchange Commission). Most recent amendment: February 25, 2008. Each Committee prepares an annual report on activities, which is published as part of the Annual Report.

(II) Name of Committee

Audit Committee

Brief description

The Regulations of the Audit Committee and the Regulations of the Appointments and Remuneration Committee are both available from the company’s website and also from the CNMV (Spanish Securities and Exchange Commission). Most recent amendment: February 25, 2008. Each committee prepares an annual report on activities, which is published as part of the Annual Report.

B.2.6 Indicate whether the composition of the Executive Committee reflects the participation on the Board of the different categories of directors:

Not applicable – there is no Executive Committee.

If not, explain the composition of the executive committee

There is no Executive Committee

C - Related-party transactions

C.1 Indicate whether the Board, sitting in plenary session, has reserved for itself the function of approving, following a favorable report from the Audit Committee or any other body entrusted with this task, transactions that the company performs with directors, with significant shareholders or shareholders represented on the Board, or with related parties:

Yes

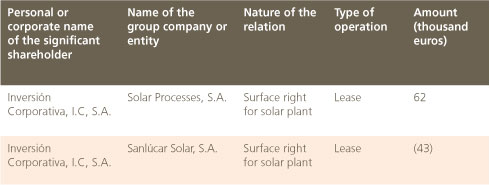

C.2 Give details of any relevant transactions involving a transfer of assets or liabilities between the company or group entities and significant shareholders in the company:

On April 16, 2009, the company Sanlúcar Solar, S.A. (the owner of the PS10 solar power plant) waived part of its surface right previously executed on January 15, 2003 for an initial term of 30 years. The waiver in question extended to 3.04 hectares of a plot spanning 69 hectares on a property owned by the company Explotaciones Casaquemada, S.A. (subsidiary of the company Inversión Corporativa, I.C., S.A., the latter being the reference shareholder of Abengoa, S.A.) and located within the municipal district of Sanlúcar La Mayor (Sevilla – Spain), with the rest of the surface right remaining unaffected.

By reason of the waiver, Explotaciones Casaquemada, S.A. returned to Sanlúcar Solar, S.A. the sum of €43,384, a proportional amount calculated on the initially paid price, the days remaining of the term of the surface right and the surface area subject to the waiver.

Furthermore, on April 16, 2009, the company Solar Processes, S.A. (owner of the PS20 solar power plant) entered into a surface right agreement over the above-referenced 3.04 hectares owned by Explotaciones Casaquemada, S.A. (subsidiary of the company Inversión Corporativa, I.C., S.A., the latter being the reference shareholder of Abengoa, S.A.).

Pursuant to the terms of the agreement, the duration of the surface right coincides with the remaining term of the surface right that the company Solar Processes, S.A. (owner of the PS20 solar power plant) created on February 7, 2007, such term amounting to 30 years, extendable to 50. The consideration for the right amounted to €61,999.

C.3 Provide details of any relevant transactions involving a transfer of assets or liabilities between the company or Group entities and the company’s managers or directors:

C.4 Provide details of relevant transactions carried out by the company with other companies belonging to the same group, provided they are not eliminated during the process of preparing the consolidated financial statements and do not form part of the normal business of the company in terms of their subject and applicable terms and conditions:

There are currently no intra-group operations other than those stemming from the company’s normal course of business.

C.5 Indicate whether the members of the Board of Directors have, over the course of the financial year, found themselves embroiled in any conflict of interest, in accordance with that set forth in article 127 ter. of the Spanish Public Limited Companies Act (Ley de Sociedades Anónimas).

No (outside the situations regarding their appointment as Board members or appointments to associated committees).

C.6 Provide details of any mechanisms in place to detect, determine and resolve possible conflicts of interest between the company and/or its group and its Board members, executives or significant shareholders.

The Audit Committee is the body responsible for monitoring and resolving conflicts of interest. Directors are obliged, in accordance with the provisions of the Regulations of the Board of Directors, to inform the Board of any situation of potential conflict, in advance, and to abstain until the Committee has reached a decision.

C.7 Is more than one group company listed in Spain?

Yes

Identify any subsidiaries that are listed:

Listed Subsidiary

Befesa Medio Ambiente, S.A.

Indicate whether the respective business lines and possible business relations among such companies have been publicly and precisely defined, as well as those of the listed subsidiary with the other group companies:

Yes

Define any business relations between the parent company and the listed subsidiary company, and between the latter and the other group companies:

Abengoa, S.A. is the parent company of a corporate group and operates as such. It therefore brings together a raft of complementary activities for a fully-comprehensive product that one or more business groups jointly offer their clients. As a result, the different companies and business groups share customers and join together as and when required, with one or other thereof acting as parent company on a case-by-case basis. This produces cross sales among companies (intra-group).

Identify the mechanisms envisaged to resolve any conflicts of interest between the listed subsidiary and the other group companies:

Mechanisms to resolve possible conflicts of interest

Intra-group operations that may pose a conflict of interest and the transfer price policy are all analyzed by the Audit Committee.

D - Control Systems

D.1 General description of the risk policy of the company and/or its group, detailing and evaluating the risks covered by the system, together with an explanation of why these systems are adequate for each type of risk.

Abengoa manages its risks through a model aimed at identifying the potential risks of a business. This model considers 4 important areas that are subdivided into 20 categories of risks, which contemplate more than 130 potential risks of a business.

Our model contemplates the following areas and categories of risks:

- Strategic Risks: Corporate governance, strategic and R+D+i projects, mergers, acquisitions and divestments, planning and assignment of resources, market dynamics, communication and relation with investors

- Operational risks: Human resources, information technologies, physical assets, sales, supply chain, threats or catastrophes.

- Financial Risks: Cash flow and credit, markets, taxation, capital structure, accounting and reporting.

- Legal Risks: Regulations, laws and codes of ethics and of conduct.

Risk Management at Abengoa is based on two significant bases:

a) the Common Management Systems, which serve to mitigate business risks

b) internal control procedures designed following the SOX (Sarbanes-Oxley Act) to mitigate risks linked with the reliability of financial information.

Both elements make up an integrated system that permits an appropriate management of the risks and controls at all levels of the organization.

This is a live system that undergoes continuous modifications to remain in line with the reality of business.

There are also internal auditing services in charge of ensuring the compliance with and the good functioning of both systems.

Business risks

Procedures geared towards eliminating business risks are instrumented through what is referred to as “Common Management Systems” (CMS).

The Common Management Systems of Abengoa develop the internal rules governing Abengoa and its chosen approach to assessing and controlling risk. They represent a common culture in the business management of Abengoa, in that they permit the sharing of accumulated knowledge and they set the criteria and patterns of action.

The CMSs serve to identify both the risks embedded in the current model as well as the activities of control that mitigate them and they mitigate the risks inherent to the activity of the Company (business risks), at all possible levels.

There are 11 internal policies with 28 subsections that define how to manage each of the potential risks included in the Abengoa risks model.

The CMSs include some specific procedures that cover any action that may entail a risk for the organization, whether economic or not. In addition, they are available for all employees in IT media regardless of the geographical location and post of the employees.

For that reason, they contain, amongst other aspects, a series of authorization forms that must be filled in order to be granted approval for any action that may bear a financial repercussion on the Company, as well as in actions associated with other kinds of indirect risks (image, relationship with investors, press releases, information systems, access to applications, etc). All the forms filled in follow a cascading system of approvals passing through the company’s organs of approval, business units, corporate departments, and are finally approved by the Chairperson.

The CMSs also include specific annexes aimed at helping to clarify the way to act in specific cases. They include aspects as varied as models of investment analysis and evaluation, up to corporate identity rules.

The following are also achieved through Common Management Systems:

- Optimization of daily management, applying procedures geared towards financial efficiency, reduction of expenses, homogenization and compatibility of information and management systems.

- Promoting the synergy and creation of value of the various Business Units of Abengoa.

- Reinforcing the corporate identity, respecting the values shared by all the companies of Abengoa.

- Achieving growth through strategic development, searching for innovation and new opportunities on short- and long-term bases.

The Systems cover the whole organization at three levels:

- All Business Units and Areas of Activity

- All levels of responsibility

- All types of operations

Compliance with what is set forth in the Common Management Systems is compulsory for the whole organization, which is why all its members are bound to know them. Any exceptions to said compliance with said systems must be made known to the person in charge and must be conveniently authorized through the relevant authorization forms.

Besides, they are constantly undergoing updates that permit the incorporation of good practices to each of the fields of action. To facilitate their spreading, successive updates are immediately communicated to the organization through IT media.

At all times there are people in charge for each of the regulations entailed in the CMSs who assure the implementation of the procedures that consider all the relevant actions in their area, to mitigate anything that could derive in a financial or non-financial risk for Abengoa. It is them who are in charge of permanently updating the CMSs and placing them at the disposal of the whole organization.

In addition, those in charge of each of the policies of the Common Management Systems must verify and certify compliance with said procedures. Each year’s certification is issued and submitted to the Audit Committee in January the following year.

Risks in relation to the reliability of financial information

In 2004 Abengoa started a process of adjusting its internal control structure on financial information to fit the requirements set forth by Section 404 of the SOX Act. Said adjustment process ended in 2007, although it is still being implemented in the new company acquisitions which occur each year.

The SOX Act was enacted in the United States in 2002 for the purpose of guaranteeing the transparency in management and the veracity and reliability of the financial information published by companies trading on the US market (SEC registrants). This Act requires that companies subject their internal control systems to formal auditing by the auditor of their financial statements who, in addition, would have to issue an independent opinion on them.

Following the instructions of the Securities and Exchange Commission (SEC), compliance with said Act is compulsory for companies and groups listed on North American markets. Thus, and although only one of the Business Units – Information Technologies (Telvent) – is obliged to comply with the SOX Act, Abengoa deems it necessary to comply with these requirements in both the subsidiary listed on NASDAQ as well as in the rest of the companies, because the risks control model used by the company is completed with it.

Abengoa considers this legal requirement as an opportunity for improvement and, far from simply conforming to the precepts set forth in the law, it has tried to develop its internal control structures, the control and assessment procedures applied up to the maximum level.

The initiative is a response to the rapid expansion the group has undergone over the past years, and to the expectations of future growth, and for the purpose of being able to continue ensuring investors the preparation of accurate, timely and complete financial reports.

Also for the purpose of complying with the requirements in section 404 of the SOX act, Abengoa redefined its internal control structure following a Top-Down approach based on risk analysis.

Said risk analysis, entails the initial identification of significant risk areas and the assessment of the controls that the company has over them, starting from those executed at the highest level – corporate controls and supervision – and then down to the operational controls present in each process.

In this sense we defined 53 Management Processes (POC) grouped in Corporate Cycles and Business Units Common Cycles.

These processes have identified and put in place a series of activities of control (manual, automatic, configurable and inherent) that guarantee the integrity of the financial information prepared by the company.

Likewise, these controls are also present in the areas of Change, Operation and Security of the Systems, as well as in the Separation of Functions, that complement the Information Safety and Security Management System, providing a high level of security in the applications.

These processes and their over 450 activities of control catalogued as relevant are subjected to verification by internal and external auditors.

Other existing tools

The company has a Corporate Social Responsibility master plan that involves all the areas and is implemented in the five business units, adapting the CSR strategy to the social reality of the various communities in which Abengoa is present. Corporate Social Responsibility, understood as the integration of the Expectations of interest groups into the Company’s strategy, the respect for the Law and the consistency with international standards of action, is one of the pillars of the Abengoa culture. The company informs its interest groups on the performance in the various CSR matters through a report following the GRI standard for preparing sustainability reports. This report will be externally verified as part of the company’s commitment to transparency and rigour.

In 2002 Abengoa signed the United Nations World Pact, an international initiative aimed at achieving the voluntary commitment of entities regarding social responsibility, by way of implementing ten principles based on human, labour and environmental rights and on the fight against corruption. Also, in 2008, the company signed the Caring for Climate initiative, also from the United Nations. Consequently, Abengoa put in motion a system of reporting on greenhouse gas (GHG) emissions which would permit it to register its greenhouse gas emissions, know the traceability of all its supplies and certify its products and services.

In 2009, we developed a system of environmental sustainability indicators that would contribute to improving the management of the company’s business, thus permitting us to measure and compare the sustainability of its activities, and to establish improvement objectives for the future. The combination of both initiatives places Abengoa at the helm of world leadership in sustainability management

D.2 Indicate whether any of the different types of risk affecting the company and/or its group (operating, technological, financial, legal, image-related, tax, etc.) materialized during the financial year.

No

If so, indicate the circumstances that led to them and whether the established control system worked.

D.3 Indicate whether there is a committee or other governing body responsible for establishing and supervising these control devices.

If so, provide details of its functions.

Name of the committee or body

Audit Committee

Description of functions

To inform the Board of any change in accountancy criteria and risks either on or off the balance sheet.

D.4 Identification and description of the processes for complying with the different regulations that affect the company and/or its group.

- nternal Control System Design:

In Abengoa, we believe that an appropriate internal control system must ensure that all relevant financial information is reliable and known by the Management. Thus it is considered that the model created and adjusted to the SOX (Sarbanes Oxley Act) completes and complements the Common Management Systems created for the main purpose of controlling and mitigating business risks.

The COSO model is taken as conceptual framework of reference, because it is that which draws nearest to the approach required by SOX, which has also been presented to the Audit Committee. In this model, internal control is defined as the process followed for the purpose of providing a degree of reasonable security for the achievement of some objectives such as the compliance with the laws and regulations, the reliability of the financial information and the efficacy and efficiency of the operations. - Supervision and control of the Risk Management model:

The supervision and control of the risk management model of Abengoa is structured around the Joint Auditing Services. These bring together the auditing teams of the companies, Business Units and corporate services, who act in a coordinated manner and depend from the Audit Committee of the Board of Administration

General Objectives - To prevent the audit risks of the group’s companies, projects and activities, such as fraud, capital losses, operating inefficiencies and, in general, any risks that could affect the healthy running of the businesses.

- To control the application and promote the development of adequate and efficient management regulations and procedures, in accordance with the corporate Common Management Systems.

- To create value for Abengoa by fostering the generation of synergies and the use of optimal management practices.

- To coordinate working criteria and approaches with external auditors to achieve optimum efficiency and returns from both services.

Specific Objectives - To evaluate the audit risk of Abengoa’s companies and projects, in accordance with an objective procedure.

- To define standard types of internal control and audit work with the aim of developing the corresponding work plans, with the appropriate scope for each situation. This typology ties in with the evaluation of audit risks, determines the work plans and involves appropriate standards of recommendations and reports. It must, therefore, be used explicitly in such documents.

- To guide and coordinate the process of planning the internal control and audit work of the companies and business groups; to create a procedure for notifying and communicating such work to the affected parties, and to establish a coding system for the work to ensure adequate control and monitoring thereof.

- To define the process for communicating the results of each audit work, the affected parties and the format of the documents in which the results are published.

- To review the application of the plans, the adequate performance and supervision of the work, the prompt distribution of the results and observance of the recommendations and their corresponding implementation.

Abengoa’s internal audit function is structured around the Joint Audit Services. These bring together the audit teams of the companies, business groups and corporate services, which act in a coordinated manner and report to the Audit Committee of the Board of Directors.

1.- Financial Reporting

The Group’s financial information essentially comprises the consolidated financial statements, drawn up quarterly, and the full consolidated annual accounts, drawn up annually.